Email Id : kmvoffice1886@gmail.com,

kmvjalandhar@yahoo.com

Reception Desk : 0181-2296605, 2296606

For Admission related queries : 9814406986

For Examination & Migration Related queries: 8283947208

For Fee Related queries: 7009711914

For Student Related issues: 9646776108

For online admission (Technical queries): 9464784459

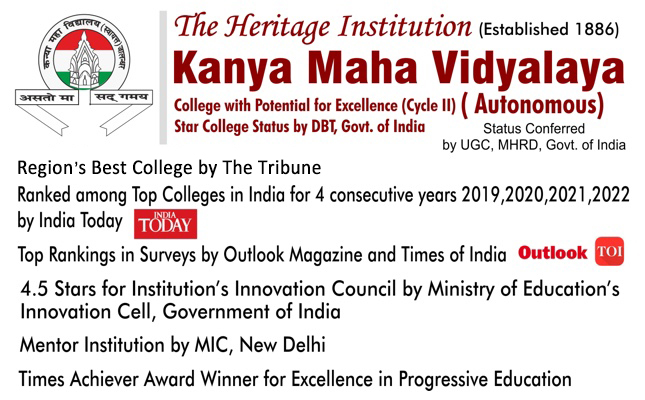

- Only College under GNDU to be bestowed with CURIE grant by DST- Govt. of India

- Star College by DBT- Govt. of India

- FIST supported by DST- Govt. of India

- Designated College with Potential for Excellence

- Accredited ‘A’ by UGC-NAAC

- Kaushal Kendra by UGC, MHRD, Govt. of India and first College under GNDU to have been granted Kaushal Kendra

- Best College in Punjab as per the Surveys

- Times Achiever Award Winner for Excellence in Progressive Education

June 10, 2021

Kanya Maha Vidyalaya- the Heritage & Autonomous institution, Seat of Women Empowerment with Top National and State Rankings by India Today Survey of Best Colleges 2020 (various categories) & Outlook Magazine has always been making efforts for the holistic development of its students. In keeping with this tradition, P.G. Dept. of Commerce and Business Administration in collaboration with Institute of Chartered Accountants of India organised one day workshop on Practical Aspects of Goods and Services Tax for the students of B.Com, B.B.A and M.Com. The workshop was attended by more than 300 participants. The resource person of the workshop was CA Navya Malhotra, Associate Member, Institute of Chartered Accountants of India, New Delhi. CA Sonia Arora, Chairperson, Jalandhar Branch of NIRC of ICAI and CA Chandan Narang, Former Vice Chairman and Secretary of Jalandhar Branch of NIRC of ICAI were the special guests for this workshop. CA Chandan Narang highlighted the importance of GST.CA Navya Malhotra acquainted students with concepts like types of GST, inter state and intra state transactions, place & time of supply, fixed establishment, input tax credit, system of reverse charge mechanism, HSN, SAC and compensation cess with help of suitable illustrations.He also discussed the various forms of invoicing – tax invoice, bill of supply and delivery challan in detail. He gave practical demonstrations to explain the different types of GST Returns. After the session, queries of the participants were eloquently explained by the resource person. Principal Prof Dr. Atima Sharma Dwivedi averred that these kind of activities are indeed a learning and knowledge enriching experience for the students as well as the faculty members. Madam Principal lauded the efforts of P..G.Department of Commerce & Business administration for taking initiatives to make the students abreast of the latest developments in the field of Commerce and Industry. Dr Neeraj Maini, Head, P.G. Department of Commerce and Business Administration proposed a formal Vote of Thanks.